Do you make card payments often or have you come across bank sort codes and account numbers? It’s not an accident. These are popular bank details for transactions within the GBP payment zone including cards payments. What is their meaning? We’ll figure it out in this article with bank numbers. What is a sort code and account number?

Basically, these bank codes are essential for internal money transfers and for transmitting messages between banks. Standardized numbers are needed to ensure payments are sent to the correct account. They facilitate faster money transfers, and the sort code account structure, for example, is designed to minimize errors the same as card ones. Let’s break down the topic of the sort code in more detail with the PaySaxas professional team.

What is a sort code?

A sort code is a distinct six-digit number primarily used by banks in the UK. To complete domestic transfers within the UK, the sender must provide both the sort code for bank account and the account number without using a card.

Occasionally, individuals use this bank number to underscore that the sort code specifically identifies a particular branch of a bank. Alternatively, some simply refer to it as a bank sort code. However, this can be somewhat misleading because every sort code number includes the essential details to direct payments to your bank and the specific branch where the account was established with a sort code.

What is the sort code on a debit card? The sort code, usually shown in two-digit pairs like 12-34-56, works alongside your bank account number to handle transactions, especially for domestic transfers within the UK. You’ll typically locate the sort code near the account number on either the front or back of your bank debit card.

What is an account number?

A bank account number even without sort code uniquely identifies a specific bank account not like a credit card. Their length and format can differ based on the institution or service the same as sort code. For financial transactions, your account number serves as a unique bank identifier, akin to a fingerprint, confirming your identity for transactions and account updates.

If you’re wondering how many digits in a bank account number are, there’s a simple answer. Bank account numbers usually range from 8 to 12 digits, though they can sometimes be longer. Now in addition to the meaning of sort code, you also know the concept of the second part of the UK bank details pair.

Is it safe to give your sort code and account number?

To answer this question directly, there is generally no issue with providing these banking details like sort code to third parties. Always be careful who you work with and who will be the payer from different banks. When handing over your account no and sort code, you should realize that people may try to set up a direct debit with your details or with the cards.

By themselves, these bank digits like sort code usually aren’t enough for someone to access your account without your permission, but they can be used to establish direct debits or other financial transactions. Make sure to share your banking information like a sort code only with reputable entities and avoid disclosing it publicly or to unverified sources.

Where can I see my account number and sort code?

Now that you know what sort and account number are, the next step is to find the details. Fortunately, they are always close at hand, as they can be found within your financial documents. Look at your online banking app or website, where your sort code will be shown alongside your account number and card details.

Alternatively, you can reach out to your bank directly via phone, email, or by visiting a branch to request these digits. The sort code on your bank card can be found either on the front or back. Look for a six-digit number grouped into three pairs of two digits each; this is your sort code. It is usually located below your name and beside your account number.

Can sort codes and account numbers be used for international transfers?

Sort codes and account numbers are mainly used for bank transfers within a single country without a card. The first sort code number type globally identifies the recipient’s bank, while the IBAN offers a standardized format for bank account identification.

These digits help ensure international transfers are accurate and secure. The same applies for sort code on a debit card. It’s an unreliable aid to international payment. Keep this in mind when you plan to make a bank transaction to partners or providers abroad with or without a card.

Manage money globally with PaySaxas

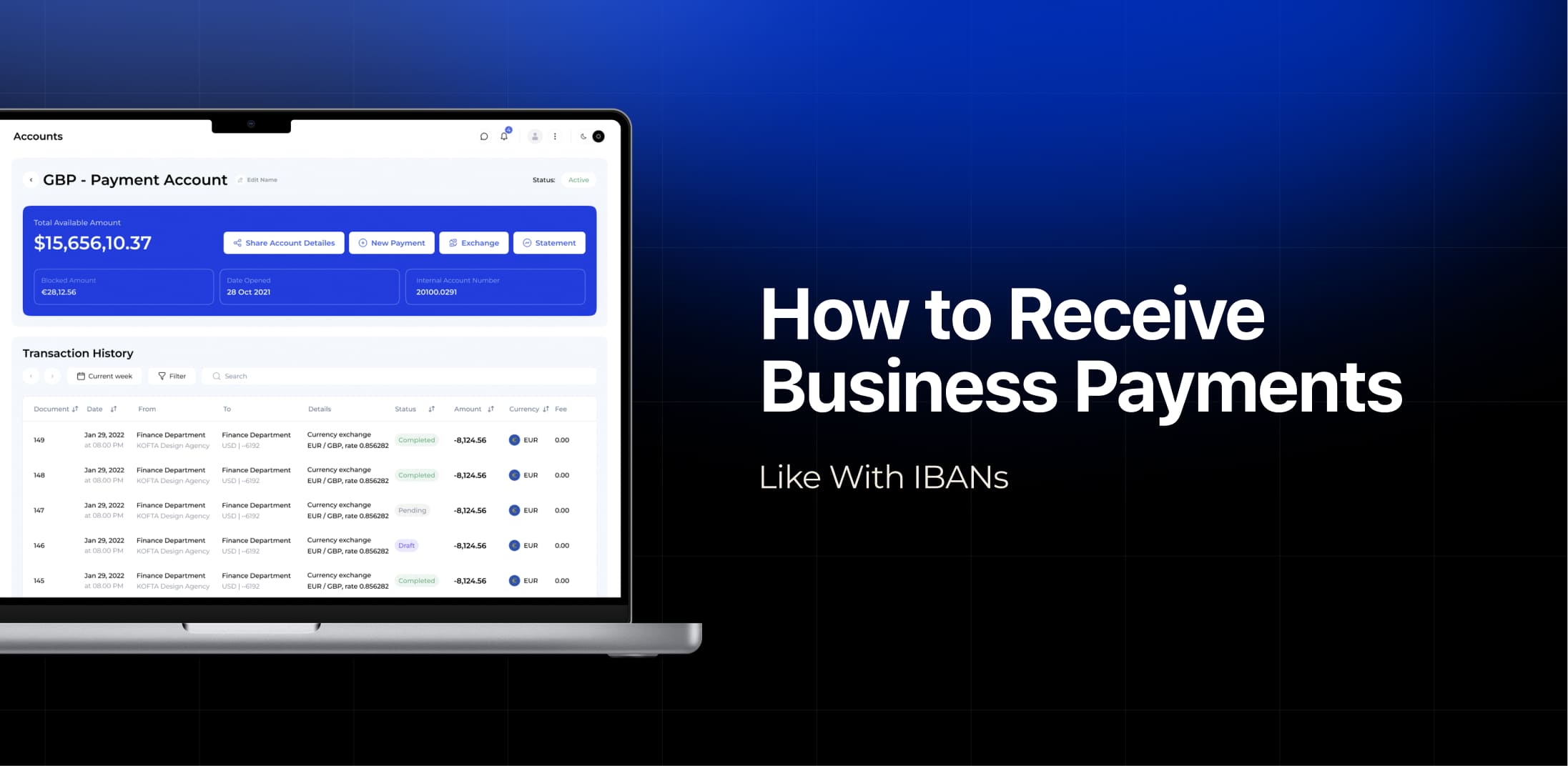

Unlike traditional UK bank account, by taking advantage of PaySaxas services, you can easily pay your English contractors for services to their bank account numbers. Basically, it is an online payment platform tailored for businesses to oversee their finances globally. It provides multi-currency accounts, facilitates cross-border payments and incorporates additional features with numbers.

What sets PaySaxas apart from other payment platforms is its extensive support for various currencies and countries. Each account digit number that is provided by the team after onboarding, to make the payment, is accurate and will enable the transaction movements to be made clearly.