Money Services Businesses (MSBs) operate across sectors like currency exchange, international money transfers, digital payments, and increasingly, cryptocurrency services.

PaySaxas Blog

Entering the European market represents a major milestone for any startup—but it also brings pressing logistical and regulatory hurdles

Each year, countless businesses confront the difficult challenge of being debanked – when their bank accounts are unexpectedly shut down or their applications rejected without clear reasons.

Today, companies across the European Union are looking for smarter ways to manage both fiat currencies and digital assets under one compliant structure.

Starting a fintech company is an exciting opportunity, but it comes with complex regulatory hurdles.

Coordinating payments to numerous recipients in various regions can be complex without an efficient system in place.

Expanding your company into Europe unlocks a wealth of strategic advantages – from simplified regulatory procedures to direct access to one of the world’s most dynamic economic regions.

In an increasingly unpredictable financial environment, more and more companies are facing an unsettling challenge: being debanked with little or no notice.

In today’s rapidly evolving digital landscape, the way companies handle their financial operations has undergone a significant transformation.

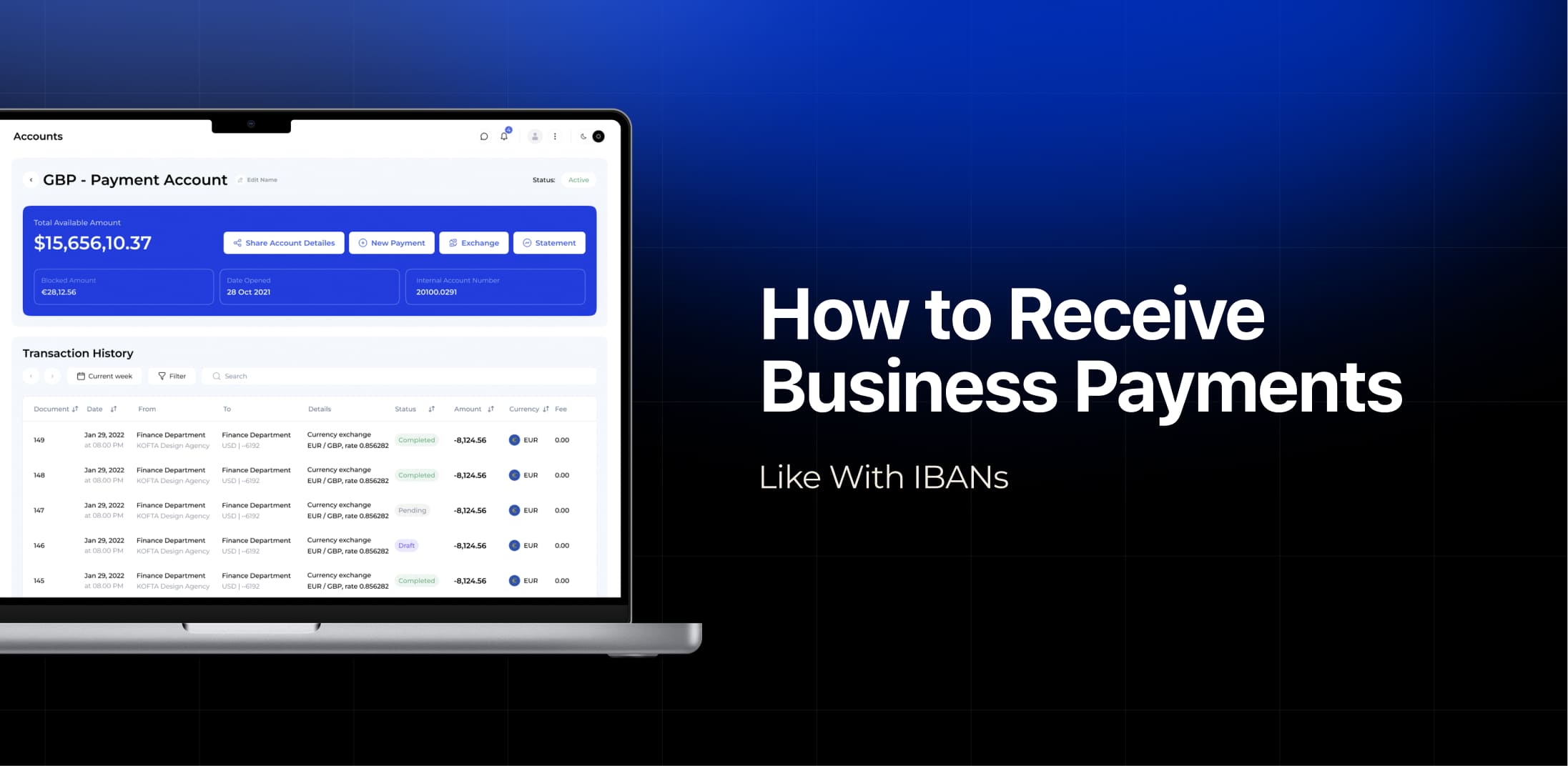

Receiving business payments, particularly from overseas partners, often involves challenges such as currency exchange issues, processing delays, and limited payment visibility.

Sending money internationally has become a routine part of life, whether you’re running a global business, working remotely, or supporting loved ones overseas.

In an increasingly interconnected and digital world, modern businesses are no longer limited by geographic boundaries.

In the dynamic world of business in 2025, the need for efficient and reliable B2B payment processes has become more critical than ever.

As global commerce continues to expand, businesses of all sizes are increasingly working with partners, customers, and suppliers across international borders.

International payments have become routine. Companies are reaching new markets, freelancers collaborate with clients overseas, and consumers often buy from foreign e-commerce platforms.