The global financial system is undergoing renewal processes. They began with the appearance of an alternative means of payment — Bitcoin — a little over 10 years ago. Soon, the number of cryptocurrencies used in settlements grew significantly, and developers are actively introducing new technologies.

Even central banks are taking a closer look at them. Private investors are also asking: what is decentralized finance? Let’s delve deeper into this topic with the experts on the PaySaxas team.

Understanding decentralized finance (DeFi)

Now you face a question: what is DeFi? Decentralized finance, or DeFi, is financial instruments in the form of services and applications created on the blockchain. The main objective of decentralized finance is to become an alternative to the banking sector and replace the traditional technologies of the current financial system with open-source protocols.

That is, to open access to decentralized lending and new investment platforms to many people. And allow them to earn passive income from cryptocurrency assets and save on fees for transfers, loans, and deposits. How does DeFi work? Some may find it challenging, but decentralized finance is organized as a peer-to-peer system, the services of which allows you to receive financial services without the need to contact intermediaries.

The ecosystem includes a variety of aspects of financial services: processing loans and credits, trading in a specific decentralized structure, investment tools, etc. DeFi banking services operate based on open-source smart contracts. When crypto-assets are transferred to a DeFi smart contract, the user does not lose control over them. He can make a reverse transaction at any time and get the original crypto asset. Smart contracts significantly reduce the influence of the human factor, but cannot eliminate errors in the code and the possibility of fraud.

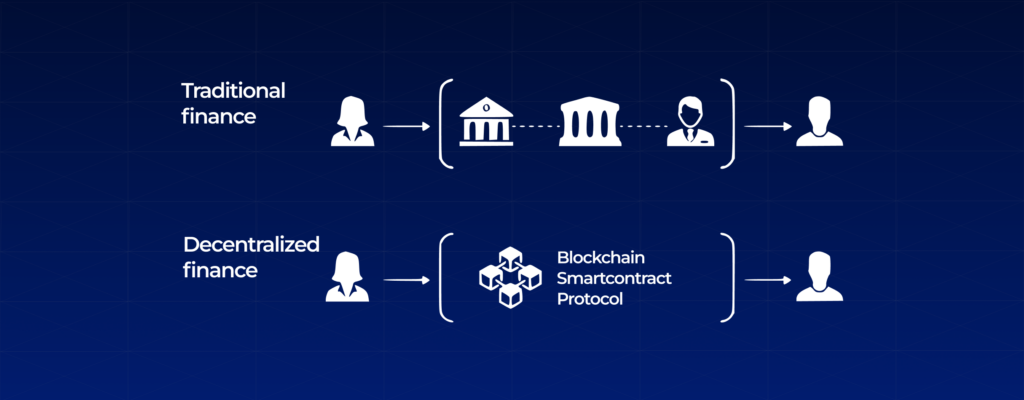

Traditional finance vs. decentralized finance

Let’s look at the distinguishing features between traditional and decentralized finance, and understand why DeFi matters for businesses.

| Traditional finance | Decentralized finance | |

| Management | Traditional financial systems have centralized control. The Central Bank is in charge of overseeing overall financial activities. | It is decentralized. In essence, it negates central management, no single institution or individual controls operations. |

| Platform | Traditional financial systems are brick-and-mortar models. They require physical space to function. | DeFi operates on a Blockchain platform. It doesn’t require a physical premise to operate. |

| Transparency | Traditional financial systems are private. You deal with your banker, agent, or broker individually. Furthermore, your true identity is revealed. | DeFi runs on Ethereum and other public Blockchains. Consequently, it is transparent. All transactions are publicly verifiable. It is a DeFi reality. |

| Control | You hand over control of your funds to several agents. The first is the central bank, which regulates the industry. Second, your bank is the custodian of your funds. The third component is the agent/agency that works for you. | You are in full control of your funds. The only prerequisites are an internet connection and smart contracts. You decide when to transact, with whom, and in what quantities. |

Benefits and opportunities of DeFi for businesses

The DeFi ecosystem has a number of advantages. Let’s familiarize ourselves with them.

Reducing transaction costs

One of the key benefits of Defi services for entrepreneurs is the potential for significantly lower costs than traditional financial systems. With Defi, entrepreneurs can bypass intermediaries and interact directly with decentralized networks. It means they can avoid paying huge fees for services such as transfers, currency conversions, or even simple payment processing. Every decentralized finance company knows what the user needs. Cost reduction is one of the first items on the list.

Borrowing and lending opportunities

One of the most popular uses of DeFi services is lending. DeFi lending platforms allow people to lend and borrow digital assets without the need for intermediaries such as banks. This opens up a world of opportunity for entrepreneurs looking to access capital or generate passive income.

Asset financing and management

DeFi banking is also revolutionizing the concept of asset management. DeFi protocols democratize asset management by allowing users to pool their funds together, automatically allocate them to different assets, and generate returns. It allows smaller investors to participate in previously exclusive investment opportunities. That’s the great DeFi reality of today.

Getting started with DeFi for businesses

Congratulations! You’re now ready to dive into the world of DeFi banking and cryptocurrencies. But before you start buying and selling digital assets, you need a safe place to store them. This device will be a cryptocurrency wallet. It is a digital wallet that holds your private keys, allowing you to safely store, send, and receive cryptocurrencies.

There are different types of cryptocurrency holders including desktop, mobile, hardware, and paper wallets. Once you have selected a provider, follow the instructions to set up your wallet. This usually includes creating an account, a password, and backing up your private keys.

The next important step is to create your first cryptocurrency exchange account. It allows you to buy, sell, and trade digital currency. Research and compare different cryptocurrency exchanges to find one that suits your needs. Register and confirm your account. Connect your payment method and start trading digital coins.

The risks and challenges of DeFi for businesses

The entire DeFi banking ecosystem is evolving, gradually entering normal life and business models. Due to financial independence and lack of regulator, the market may show exponential growth in 2024 and the following decade, but one should keep in mind possible risks:

- The most serious risk in the decentralized finance segment is the failure of a smart contract. A flaw in the source code would allow attackers to hack the protocol or use it unfairly.

- Decentralized finance company transactions are done without intermediaries, and smart contracts come with risks. They are open source, so anyone on the planet can watch all transactions.

- The lack of off-chain data is a major disadvantage of blockchain transactions. This is compensated for by oracles that give access to information, and smart contracts can use external data to make changes based on it.

DeFi helps provide a paradigm shift, overall efficiency, and transparency to engage new users in the ecosystem. Decentralized finance is the main source of Ethereum’s development. At the same time, the sector is positioned as an alternative replacement for the traditional financial sector, but for the mainstream, it will take a few years for the technology to move from niche to general.

Notable DeFi projects and their business applications

MakerDAO: decentralized reserve bank and stablecoin

It is an Ethereum-based smart contract platform that allows the issuance of Dai stablecoins against cryptocurrencies and real assets. The name of the platform comes from the term market maker. MakerDAO is in first place among the Ethereum ecosystem’s DeFi protocols in terms of blocked liquidity. Dai is among the top five largest stablecoins.

Compound: decentralized borrowing and lending

It is a decentralized protocol for working with cryptocurrency markets, allowing users to invest or borrow various assets. Interest rates are set algorithmically based on current supply and demand and can be adjusted approximately every 15 seconds (with each new Ethereum block).

Uniswap: token exchange

It is an Ethereum-based decentralized exchange (DEX) that facilitates the exchange of ERC-20 tokens between traders. As decentralized finance (DeFi banking) flourishes, the hype around the Uniswap protocol also continues to grow, but not without reason.

The Uniswap team has created a solution that the cryptocurrency community has been waiting for a long time. In addition, the automated liquidity protocol, combined with the unique management system via UNI tokens, has given users confidence, which in turn has increased the utilization of the platform.

Augur: market prediction platform

It is a blockchain service developed based on Ethereum smart contracts. The ecosystem can be classified as entertainment — the service allows you to bet on any events happening in the world. Thanks to decentralization, users will have no reason to doubt the objectivity of the results, and the use of cryptocurrency provides much lower commissions than in classic betting offices.

PoolTogether: zero loss savings platform

It is a decentralized platform for verified savings games. It is controlled by those who own POOL tokens and distributes tokens to those who make deposits into the protocol.

The future of decentralized finance for businesses

At this point, we have already been able to answer the question, what is DeFi? It is an ecosystem of publicly available decentralized financial services based on public blockchains. They enable the use of financial services such as borrowing, lending, and trading without having to rely on centralized organizations.

That’s the DeFi reality of today. For the near future, we assume the following: CeFi players will continue to lower the barriers to entry for decentralized finance company and DeFi-like projects. They will allow the benefits of DeFi to be appreciated, but retain the liquidity, stability, and security that CeFi users are accustomed to. Once these conceptual projects are tested by the market and the DeFi model proves successful, market demand will emerge.

After all, it is the appeal of financial self-sufficiency and decentralization that lies at the heart of blockchain technology’s original mission. They have the potential to bring the freedom of money to all participants, creating financial opportunities for more people than ever before. In this way, DeFi provides the final piece of the development plot for the future of cryptocurrency.

Conclusion: weighing the opportunities and risks of DeFi for businesses

It should be noted that We were able to answer the questions, what is decentralized financing, and how does DeFi work? Decentralized finance opens up easy and fast access to financial services for different categories of interested parties because 2 billion users on the planet do not have access to the conventional banking system.

At the same time, the speed of transfers in the Ethereum blockchain is many times faster than in standard banking systems, and because there is no chain of intermediaries, transaction fees are also much lower. Despite the advantages and disadvantages of the technology, you can be sure that DeFi will take the digital world to an even new level. Let’s follow together with PaySaxas on how decentralized finance will evolve.