The world is in constant motion, always evolving. New technologies continue to emerge, enhancing human life and business operations. Contemporary tools facilitate the broadening of perspectives and international interactions, effectively breaking down borders. In today’s dynamic world, the importance of foreign payments cannot be overstated.

Businesses require the ability to transfer money remotely to sustain relationships with various counterparts. Almost every bank now offers such services. Additionally, multinational payment platforms like PaySaxas have emerged, providing entrepreneurs with support and convenience.

However, regardless of the institution chosen, there are factors influencing the speed of a transaction. What specific features should be considered? What are these factors? Let’s explore these questions with the expertise of PaySaxas professionals.

Factors that affect the speed of cross-border payments

Moving funds between entities in different countries, known as cross-border payments, can be influenced by various factors that determine the speed at which these transactions are completed. Key elements that impact the efficiency of cross-border payment processing include:

- Specific international transaction processing. Every bank or payment institution possesses its own distinct features. While some aspects may overlap, others may differ entirely. It’s crucial to consider these variations when initiating a wire transfer.

- Payment method. The chosen method of sending money can significantly affect the speed of the movement. Transactions and electronic funds movements generally offer quicker processing times compared to methods such as checks or drafts, which often require additional clearing processes internationally.

- Currency conversion. The time required for currency conversion in an international transfer can vary depending on the specific currency pairs involved and whether the bank has immediate access to the necessary currencies.

- Time zone. Keep in mind that differences in banking hours and business days across time zones could potentially delay the money transfer. For instance, if an individual initiates a transaction towards the end of the business day in their country, it might not be processed until the following business day in the recipient’s country.

- Intermediary banks. During the process of sending funds across various countries, the money could traverse through several intermediary institutions, each potentially imposing its unique processing time and fee structure.

- Weekends and holidays. Bank holidays and weekends occurring in either the sender’s or recipient’s country can cause delays in the sending process, as banks typically refrain from processing transactions during these non-business days.

Enhancing the speed of cross-border payments generally requires tackling these factors by leveraging advanced technology, refining regulatory frameworks, and fostering better cooperation among financial institutions worldwide.

How international money transfers work

The money transfer process involves many components and factors. They, of course, have a significant impact on how fast an international wire transfer will be processed and credited to the beneficiary’s account. Therefore, let’s see how this action occurs in practice.

- Access to the account.

You must have an account to be able to complete the payment transaction.

- Payment request.

You must initiate the payment transaction by yourself so that the system identifies this request.

- Verification and compliance.

To ensure legality, the wire transaction is checked against international sanctions lists and other compliance requirements.

- Processing by the Sender’s Bank.

The sender’s bank debits the specified amount from their account, including any applicable fees.

- Intermediary Banks (if applicable).

Each intermediary institution handles the transaction, applies its fees, and forwards the payment to the subsequent branch in the chain.

- Processing by the Recipient’s Bank.

The recipient’s bank processes the payment order and deposits the transferred amount into the recipient’s account.

- Finalization and settlement.

The movement of funds between banks (settlement) and the updating of account balances are carried out via local or international clearinghouses and payment systems.

What makes international payments to be processed too long?

How long does it take an international wire to be processed? It is difficult to answer this question unambiguously. There are many factors that we outlined above that really affect the process and speed of money movement. Always keep these points in mind:

- Outdated technology remains a reliance for numerous banks, thereby contributing to slower processing durations.

- Stringent verification processes for anti-money laundering and counter-terrorism financing purposes necessitate meticulous checks, potentially leading to processing delays.

- Differences in international bank transfer times may cause delays, especially in cases where manual approvals or interventions are necessary.

- Utilizing diverse clearing and settlement networks, whether regional or international, can impede the process due to the distinct timing and protocols of each network.

- Political instability or shifts in governmental policies may influence the pace of payments internationally.

The processing time of international payments can be prolonged due to a complex interaction among technological, regulatory, operational, and geopolitical factors.

How long do international transfers take to go through?

The time it takes for an international bank transfer to be processed can differ based on numerous factors, such as the institutions engaged, the originating and destination countries, the selected payment mode, and regulatory mandates. All of these aspects are important.

Take them into account when creating a wire order. As experience has shown, money sent by senders is typically credited to the recipient’s account within a single day. However, your preparedness for such a transaction also matters.

Ensure you have the necessary supporting documents, such as contracts or invoices for the specified services to be provided to the institution. If all actions look logical, the final system works like clockwork, you have specified all payment details correctly, and you send funds during the working period, the money can come within 4 hours or maximum 24 hours.

How Can SMEs Boost the Speed of International Payments?

Many aspects can affect the improvement of the speed of international movement. There are various measures small and medium-sized enterprises (SMEs) can implement to accelerate the speed of the transferring money internationally:

- Choose payment methods that ensure rapid processing, such as electronic funds transfers, online banking, or digital wallets, rather than relying on conventional methods.

- Discover fintech platforms like PaySaxas and services tailored for international payments. These platforms frequently harness technology to provide quicker and more economical solutions than conventional banks.

- Verify that all essential documentation is complete and precise prior to initiating the payment. This encompasses invoices, contracts, shipping documents, and any other pertinent paperwork. Simplifying this procedure can mitigate delays caused by missing or inaccurate information.

- Monitor currency exchange rates and strategize the timing of your international payments to capitalize on favorable rates. Doing so can optimize expenses and potentially expedite transactions.

By incorporating these tactics, small and medium-sized enterprises (SMEs) can refine their international payment procedures, enhancing the speed and efficiency of their transactions.

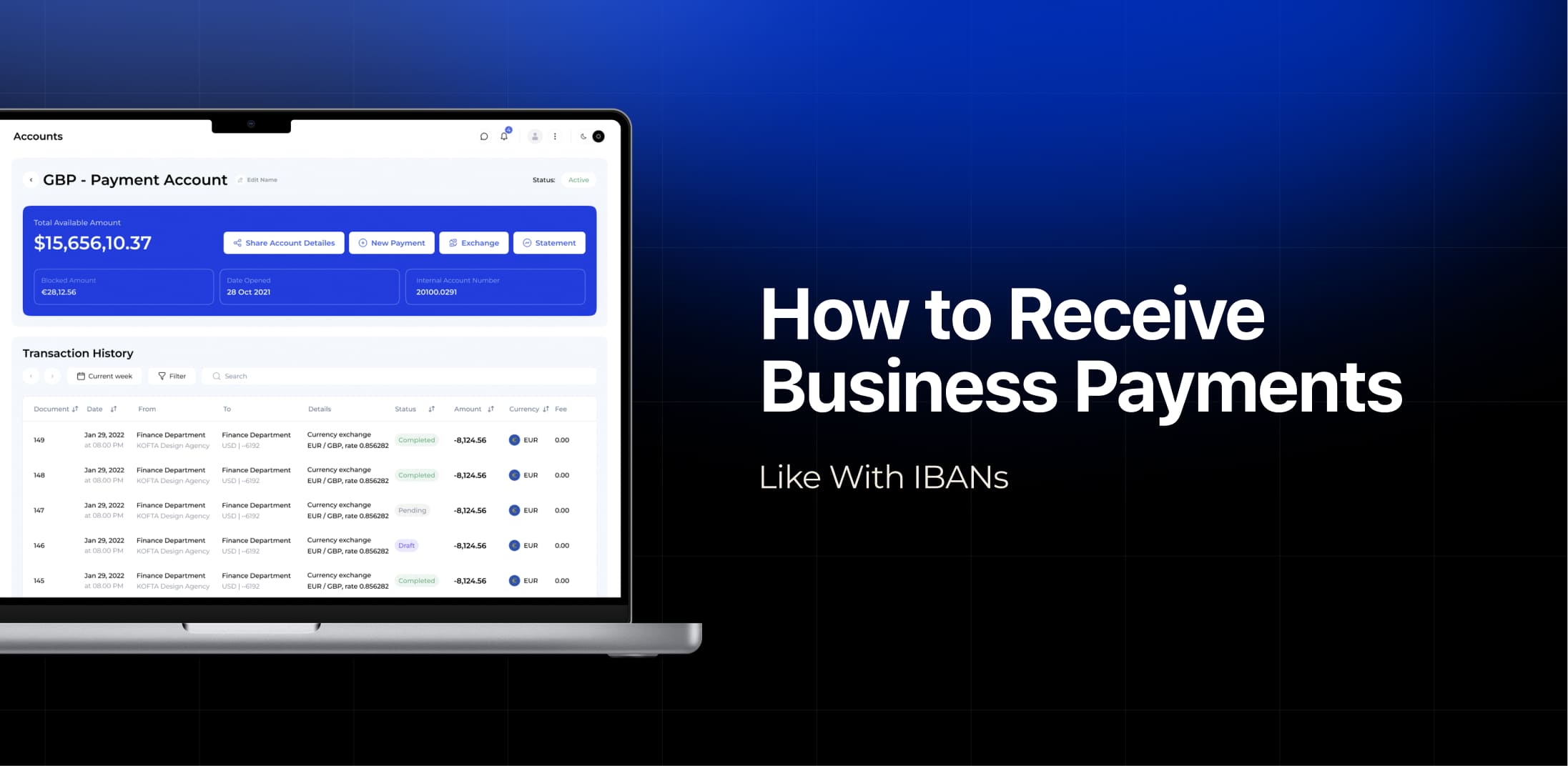

Open a Multi-Currency Account

By having a multi-currency account, you gain the ability to maintain balances in various currencies. This empowers you to make payments directly in the recipient’s local currency, eliminating the necessity for currency conversion. This streamlined process not only accelerates transactions but also mitigates associated fees.

Use a Digital Wallet

How long does an international money transfer take? With a digital wallet, the process can go faster. Such tools frequently enable instant transfers, permitting funds to be sent and received in real-time. This can markedly diminish the processing time for international money payments in contrast to traditional movements, which might span several days.

Numerous providers of digital wallets harness cutting-edge technologies, such as blockchain, to swiftly and securely facilitate cross-border sendings. These advancements enable direct peer-to-peer transactions, eliminating the necessity for intermediary banks and thus expediting the bank payment process.

Read Up on Local Culture & Financial Regulations

Getting acquainted with the indigenous business customs and cultural norms of the recipient’s nation can ease communication and negotiation channels. This cultural sensitivity fosters trust and rapport, hastening decision-making and minimizing delays in payment approvals.

Conclusion: Why speed of international transfers is important

In summary, it’s important to recognize that today, everyone, whether individuals or companies, is engaged in financial transactions. Our world is more interconnected than ever before, emphasizing the significance of collaboration, which is not only encouraged but often essential for conducting business effectively.

International funds movements are pivotal in this landscape. However, a lingering question persists: how many days will it take for an international money transfer? When making this calculation, numerous factors come into play. Typically, banks and payment systems permit a timeframe ranging from several hours to three business days for funds to be credited to the recipient’s account internationally. However, variables like disparate time zones, weekends, the participation of various financial institutions, and other factors can alter the eventual outcome.

Even if you’re making a bank international money transfer, it may take some time for the funds to be credited to your account. PaySaxas can be a trusted partner in this scenario. We provide a variety of services tailored to streamline cross-border transactions. Moreover, our fintech company was established with the aim of assisting businesses globally. We are always happy to answer your questions and resolve difficulties with international transactions for your case.